Customizing the Quick Checkout Page

You can customize the Skrill Quick Checkout page in the following ways:

- Pre-populating payment fields

- Displaying payment and order details

- Preselecting or displaying payment methods

- Displaying specific credit/debit card brands

- Straight Through Redirect

- Displaying your company logo or brand

- Embedding the Quick Checkout page

- Removing or reducing the header and reducing the footer

- Recurring billing

Pre-populating Payment Fields

To speed up the payment process for the customer, you can supply the following parameters with each transaction:

| Field name | Description | Required | Example value |

|---|---|---|---|

pay_from_email | Email address of the customer who is making the payment. Note: If a Skrill wallet account exists with this email, and the Skrill Wallet is one of the available payment method tabs, it will be selected as the default payment method. | Yes | payer123@skrill.com |

firstname | Customer's first name. | No (See Note 2) | 20 |

lastname | Customer's last name. | No (See Note 2) | 50 |

iban | IBAN that will be passed to the provider. See Note 4 | No | 28 |

account_num | Account number that will be passed to the provider. See Note 4 | No | 8 |

bank_code | Sort Code that will be passed to the provider. See Note 4 | No | 6 |

instrument_id | It will be sent after a successful transaction in the status response. It can be used with providers that support returning customer flows to make subsequent deposits faster. See Note 5 | No | 240 |

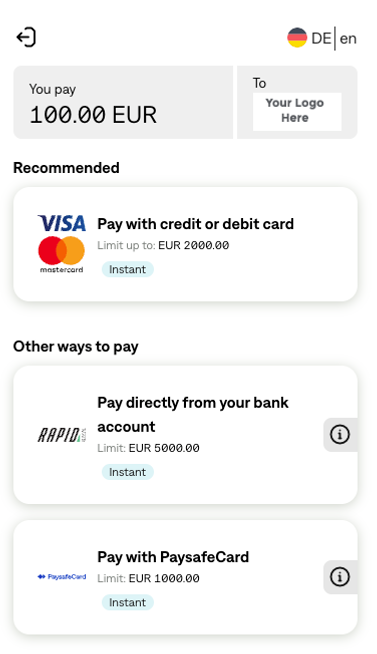

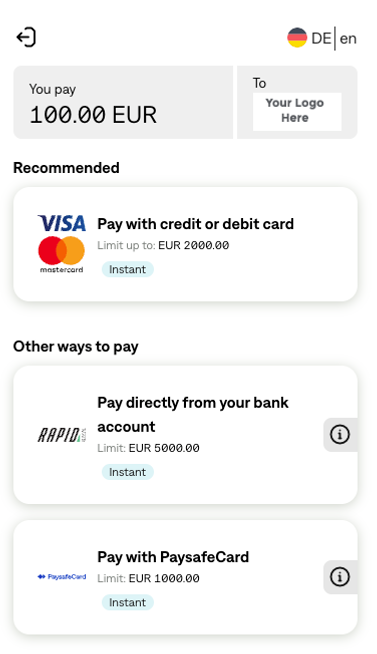

The following figure shows an example of the Quick Checkout page.

You can include additional parameters,such as the customer's address, city, country, language, postal code, and date of birth. If the customer selects the sign-up link to open a new Skrill Digital Wallet account, these fields will be prefilled on the registration form. If they are all prefilled (address, city, country and postal code), they will be hidden to simplify the sign-up form.

Displaying Payment and Order Details

You can display your company logo on Quick Checkout. To do this your payment request should include the logo parameter, with a secure HTTPS link to the logo on your website. See the example below.

<input type="hidden" name="logo_url" value="https://www.skrill.com/fileadmin/content/pdf/acme.png" />

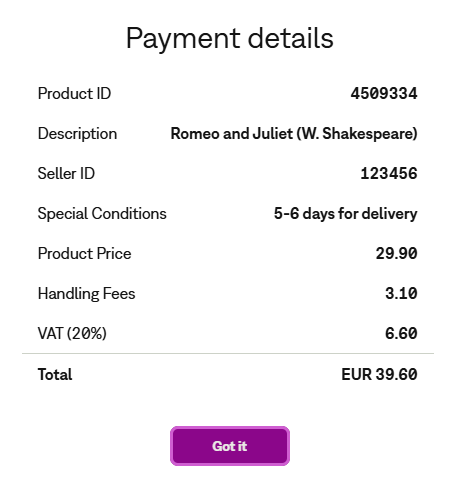

Your payment request can include your own itemised payment details, such as an order description and amount breakdown. The customer can view these payment details by selecting the information icon displayed next to the amount and currency.

Click the icon to display the Payment details overlay screen.

You can include up to five additional description fields and three amount fields (see Payment details). For an example of HTML form, which implements these fields, see Example HTML forms.

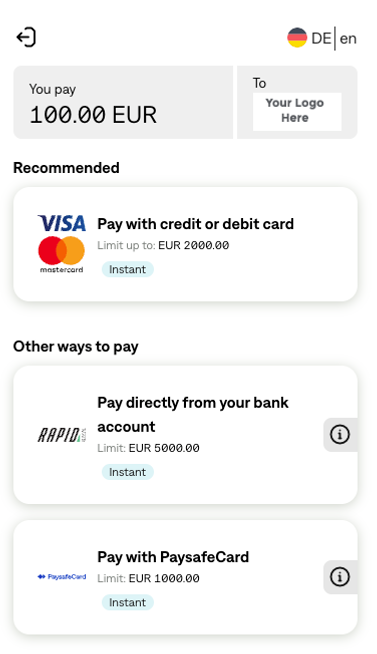

Preselecting or Displaying Payment Methods

Which payment methods are displayed depends on the configuration setting for your merchant account; there are two options: Fixed or Flexible (also known as Fixed Split Gateway or Flexible Split Gateway). This feature is set up for your account by Skrill. For details, please contact Skrill Merchant Services.

The Fixed option is used to specify the payment methods to display to customers in the Quick Checkout payment form (if these payment methods are available in the customer's country). For example, you can display only PaysafeCard, SOFORT, and Rapid Transfer on the payment form instead of the generic Skrill options for the customer's country. For a list of currently supported alternative payment methods and their codes, see Payment method codes.

The Flexible option is used to preselect a payment method and display it in the first payment method tab (if this payment method is available in the customer's country). The other payment methods available in this country are displayed in the other tabs.

The customer's country is determined by the country parameter passed to the Skrill Payment platform. If no country parameter is provided, Geolocation is used instead.

To use either option, the following parameter must be included in your payment request:

| Parameter | Description | Max Length | Example Value |

|---|---|---|---|

payment_methods | The effect of this parameter depends on your Skrill account configuration - Fixed or Flexible layout. For best performance, we recommend using the Fixed layout with the Straight Through Redirect option. In the Fixed layout, if only one payment method is provided, the customer is redirected directly to that method's site. If two or more methods are supplied, the first will appear as 'Recommended' and the rest under 'Other ways to pay', with no additional methods displayed, even if available. In the Flexible layout, the first supplied method is shown as 'Recommended', and there is no need to send multiple methods, as all available options for the customer's country will be shown automatically. Note: If you do not provide a value all the payment methods available in the customer's country are displayed and we will use internal ordering. For a full list of codes, see Payment method codes. | 100 | PSC |

Before implementing this option, you should also confirm which payment methods are available for your account. Restrictions apply for merchants who are based outside of Skrill's standard region (USA and Europe).

Fixed Payment Methods

With the Fixed payment option, when you submit a payment method using a single payment_methods parameter, only that payment method is shown to the customer on the payment form. If the payment method is not supported by the customer's country, the form shows all other available payment methods for this country. If you provide more than one payment method code separated by commas, the first payment method listed is preselected and shown in the first tab. The subsequent payment methods are then shown by order of their popularity in the customer's country. Note that this is used instead of the order they are listed in the payment_methods parameter. If a single payment code is used and this payment method is not available in the customer's country, the full list of available payment methods is presented to the customer. For example, if you submit the code for iDEAL but the customer is not a resident of The Netherlands, the customer is shown all available payment methods for their own country instead. If multiple payment method codes are used, any unavailable payment methods are ignored. The following example shows the fixed payment method option with a single code:

<input type="hidden" name="payment_methods" value="ACC" />

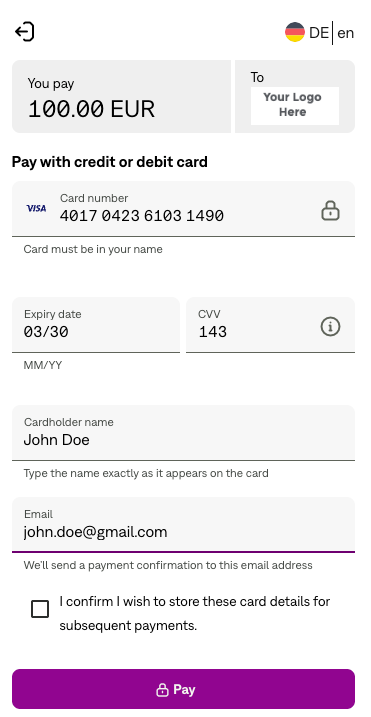

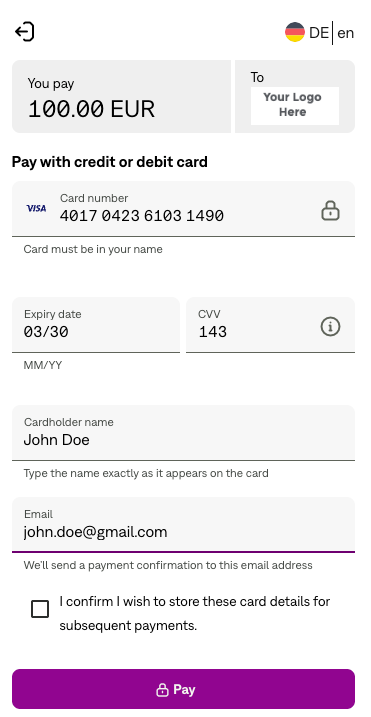

Displaying specific credit/debit card brands

By default, all card brands are displayed on Quick Checkout. You can override the default behaviour, by specifying the card brand you want to display on the payment form. This option only works with the Fixed payment method option. Use the ACC payment method code to display all available card brands. Only one card payment tab is permitted. See the example below.

<input type="hidden" name="payment_methods" value="VSA" />

Restrictions apply for merchants who are based outside of Skrill's standard region (USA and Europe).

When the customer selects the Credit/Debit Card payment tab and enters their card number in the Card number field, the card type is automatically validated and the card logo is displayed, as shown in the example below.

Straight Through Redirect

Straight Through Redirect is used with a single payment method code to automatically redirect customers to the Payment Method provider's website without showing the Quick Checkout payment form. Once redirected, the customer provides their name and any other details required and then confirms the payment. Straight Through Redirect reduces the number of steps to complete the payment. This option is only available if the following conditions apply:

- Your merchant account is set to use Fixed payment methods

- You pass a single payment method code in the

payment_methodsparameter - You provide a customer email address using the

pay_from_emailparameter, firstname parameter and lastname parameter as well as the Bank for some bank options as per the requirements in the table below. If any of the required parameters are not provided/missing, the Quick Checkout payment form will be displayed to allow the customer to enter their email address, first name, last name or select the bank. The customer will then need to click Proceed to continue. For example: Proceed to ALIPAY. The following table lists the payment methods which support Straight Through Redirect:

| Payment Option | payment_methods | pay_from_email | firstname | lastname |

|---|---|---|---|---|

| Alipay | ALI | Y | N | N |

| Boleto | BLT | Y | Y | Y |

| SafetyPay cash payment | CHP | Y | Y | Y |

| Gift cards | GFCCVSDLGOBK | Y | N | N |

| Rapid Transfer | OBT | Y | Y | Y |

| EPS * | NPY | Y | Y | Y |

| Neteller | NTL | N | N | N |

| SafetyPay bank transfer | ONB | Y | Y | Y |

| PagoEfectivo | PGF | Y | N | N |

| PaysafeCard | PSC | Y | N | N |

| Paysafecash | PCH | Y | N | N |

| Przelewy24 | PWY | Y | N | N |

| MACH | MAH | Y | Y | Y |

| Pix | SPX | Y | Y | Y |

| Khipu | KHP | Y | Y | Y |

| SPEI | SPI | Y | Y | Y |

| SOFORT | SFT | Y | N | N |

| ePay | EPY | Y | N | N |

| MyBank * | MBK | Y | Y | Y |

* To offer EPS and MyBank via straight through redirect flow you need to utilize the Bank API so you could be able to pass the last mandatory parameter - bank

Flexible Payment Methods

With the Flexible payment option, when you submit a payment method using the payment_methods parameter, that method is preselected for the customer. All other payment methods enabled for your account and for the customers' country are shown in the other payment tabs. If the chosen payment method is not supported in the customer's country, the payment tabs show all other available payment methods for this country, listed by popularity. See the example below.

<input type="hidden" name="payment_methods" value="OBT" />